It’s not a 1 April fool but it’s time again for me to have my taxes sorted out before the first of April to The ‘Belastingdienst’ (Dutch Tax Collector).

It's nice to live in a country that actually gives some of the money it collects in taxes back to the population. Like any normal country a lot of this money goes to normal things like infrastructure and defense but unlike many other countries a large amount goes into the Health Care System, Education, Environment and Social Benefits. It shouldn't therefor come as a surprise that the Dutch Health Care System is one of the best in the world. Accessible for everyone and affordable. Education can be had by all till the age of 15 (by law you have to be in school till that age) and those who want to go on, to for instance University, can do so at a reasonable costs. Costs you should easily be able to compensate when joining the workforce a few years later. And for those unemployed or unable to work we have some of the highest Social Benefits.

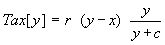

On the other hand, the Dutch Government certainly do know how to collect their forms of tax here; For example:

· BTW (Belasting Toegevoegde Waarde), the Dutch VAT, with the exception of food and medication which is 6%. With the exception of potable water which is 19% again. Known in the UK and most other (former) commonwealth countries as VAT and called sales tax in the US and Canada.

· BPM (Belasting op Personenauto’s en Motorrijwielen), that clocks in at a staggering 45.2%. There are slightly different formulas for petrol and diesel engines, but what it amounts to is that between 56.5% and 65.8% of the price is tax.

· Motorrijtuigenbelasting, the tax on passenger vechicles and motorbikes. The amount you pay depends on, whether you have a diesel, petrol or LPG vehicle, and the weight of the vehicle.

· Assurantiebelasting, car insurance premium tax at 7%.

· Overdrachtbelasting, if you buy a house, you have to pay a transfer tax at 6%. If it were newly built, you have to pay BTW at 19%.

· Onroerende-zaakbelasting, property tax that is broken down into two parts. The owner’s part (is the owner of the property) and the user’s part (is the person who lives there). If the owner and the user are the same person, that person is responsible for paying both parts.

· Eigenwoningforfait, is a tax on living enjoyment based on the assumption that you will derive pleasure from living in property that you own.

· Succession tax, should you inherit money, a major chunk goes right into taxes. The testator has already paid income tax and everything else on it while (s)he was alive, but now that the money changes hand, the revenue service makes off with another part of it, for no apparent reason.

· Dog tax, if you own a dog, you pay tax. For no apparent reason, as the dog has no income of its own.

There are also communal taxes, which are calculated and applied locally. You pay environmental tax to cover the costs of sewage treatment and waste disposal, except that in some cities you again have to pay separate waste disposal rates on top of that.

Then there are special duties. Some goods (especially fuels and alcohol) carry a special duty that can amount to 50% or more. Ostensibly these duties are intended to discourage the product from being overused. Heavy taxes at the gas station and at the liquor store will help conserve energy and fight alcohol addiction, or so we are told. And the beauty of it is that BTW (VAT, sales tax, what have you) is paid over these special duties as well. So we're paying tax over the taxes we pay.

And, while reading the text and complaints, please do remember that The Netherlands is one of richest countries in the world, that the Dutch - after Sweden - pay the highest taxes in the world and the fact that the government here levies taxes hardly makes it unique…

No comments:

Post a Comment